Enes Akkal

Bridging business needs with practical solutions.

About Me

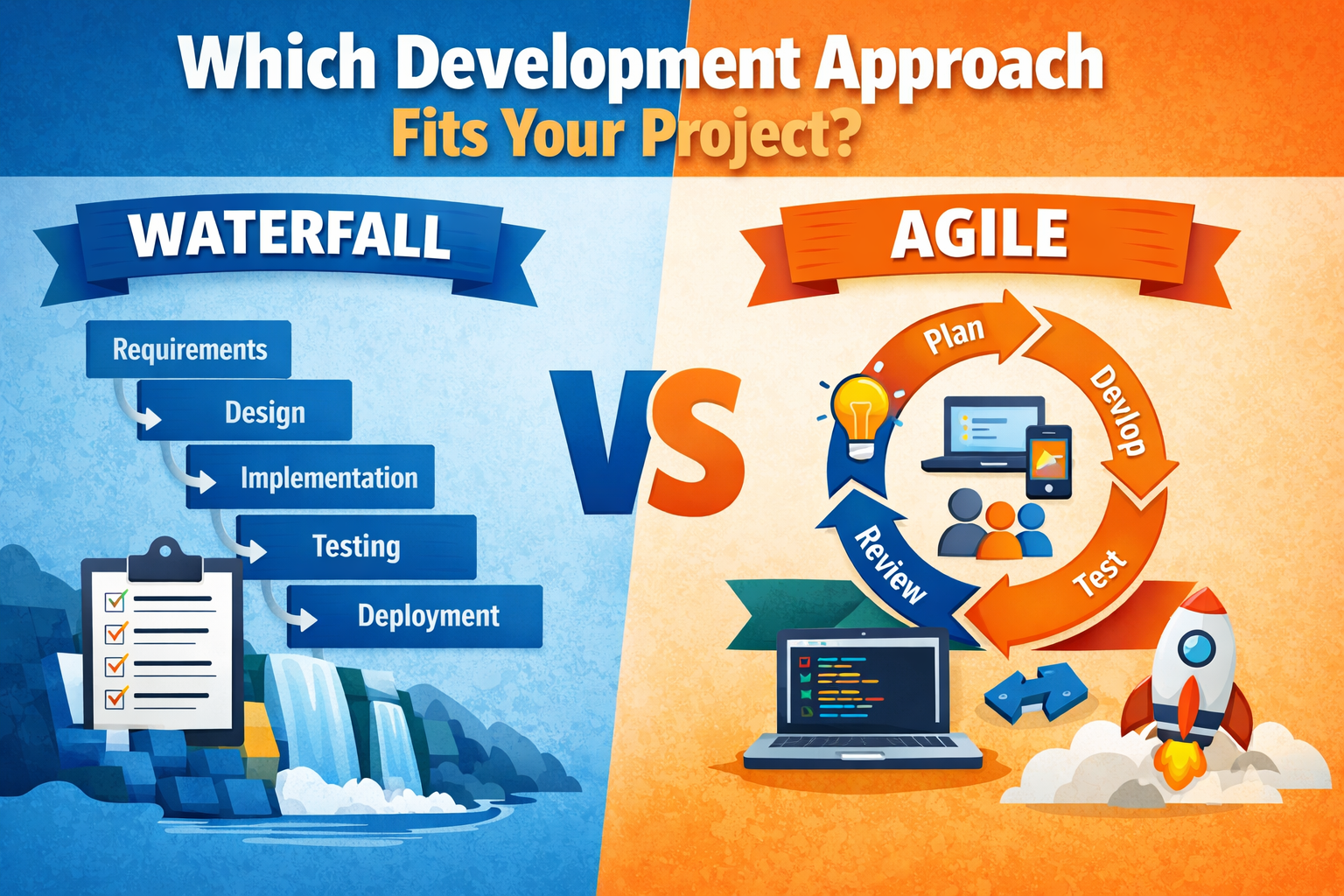

I am a product management professional with over five years of experience in the banking industry, specializing in the design, development, and optimization of digital financial products. Throughout my career, I have worked closely with cross-functional teams to translate business needs into clear requirements, prioritize backlogs, and deliver customer-centric solutions in highly regulated environments.

I am currently transitioning into a Business Analyst role, where I aim to leverage my strong background in requirements analysis, stakeholder management, process improvement, and data-driven decision-making. My hands-on experience as a Product Owner has provided me with a deep understanding of both business and technology perspectives, enabling me to bridge gaps between stakeholders and technical teams effectively.

I hold a Master's degree in Software Engineering from Boğaziçi University, which has strengthened my analytical thinking and technical foundation. I am motivated to apply these skills in a Business Analyst capacity to drive meaningful insights, support strategic initiatives, and contribute to impactful business outcomes.

I am currently transitioning into a Business Analyst role, where I aim to leverage my strong background in requirements analysis, stakeholder management, process improvement, and data-driven decision-making. My hands-on experience as a Product Owner has provided me with a deep understanding of both business and technology perspectives, enabling me to bridge gaps between stakeholders and technical teams effectively.

I hold a Master’s degree in Software Engineering from Boğaziçi University, which has strengthened my analytical thinking and technical foundation. I am motivated to apply these skills in a Business Analyst capacity to drive meaningful insights, support strategic initiatives, and contribute to impactful business outcomes.

Work Experience

My professional journey and key accomplishments

Deposit Products Marketing & Analysis Manager

TEB BNP Paribas Joint VentureLed end-to-end requirements analysis for new deposit and investment products, working closely with business, IT, and operations teams to translate business needs into system-ready functional requirements.

Designed and executed targeted marketing campaigns to increase customer engagement for Marifetli Account.

Conducted in-depth analysis and forecasting of product performance, including profitability projections, cost of funds evaluation, and revenue contribution.

Key Achievements

- Developed analytical models and forecasts to assess product performance under different market scenarios, supporting evidence-based decision-making.

- Reduced first-90-day customer churn by ~10% by identifying early drop-off causes and refining campaign timing and messaging.

- Optimized deposit pricing by analyzing customer price sensitivity across multiple balance brackets, enabling differentiated interest rate strategies and achieving a ~0.20%–0.30% improvement in overall interest rate stance.

Deposit Products Senior Specialist

ICBC TurkeyIdentifying improvement areas for business growth and enhancing products under my responsibility, including deposit accounts, money transfer and other financial offerings.

Gathering and analyzing business needs for new projects, ensuring alignment with organizational goals and conducting User Acceptance Tests (UAT).

Performing in-depth market research to identify new business opportunities, monitor industry trends, and assess competitive positioning.

Leading projects from initiation to completion, including planning, execution, monitoring, and closure, while collaborating with cross-functional teams.

Key Achievements

- Contributed to ~5% growth in total bank deposits by assisting the integration and launch of the YUVAM account, expanding the bank’s FX-protected deposit offering and attracting new customer inflows.

- Improved product delivery quality by strengthening requirement analysis and UAT processes, reducing rework and post-implementation fixes.

Education & Qualifications

My Academic Background

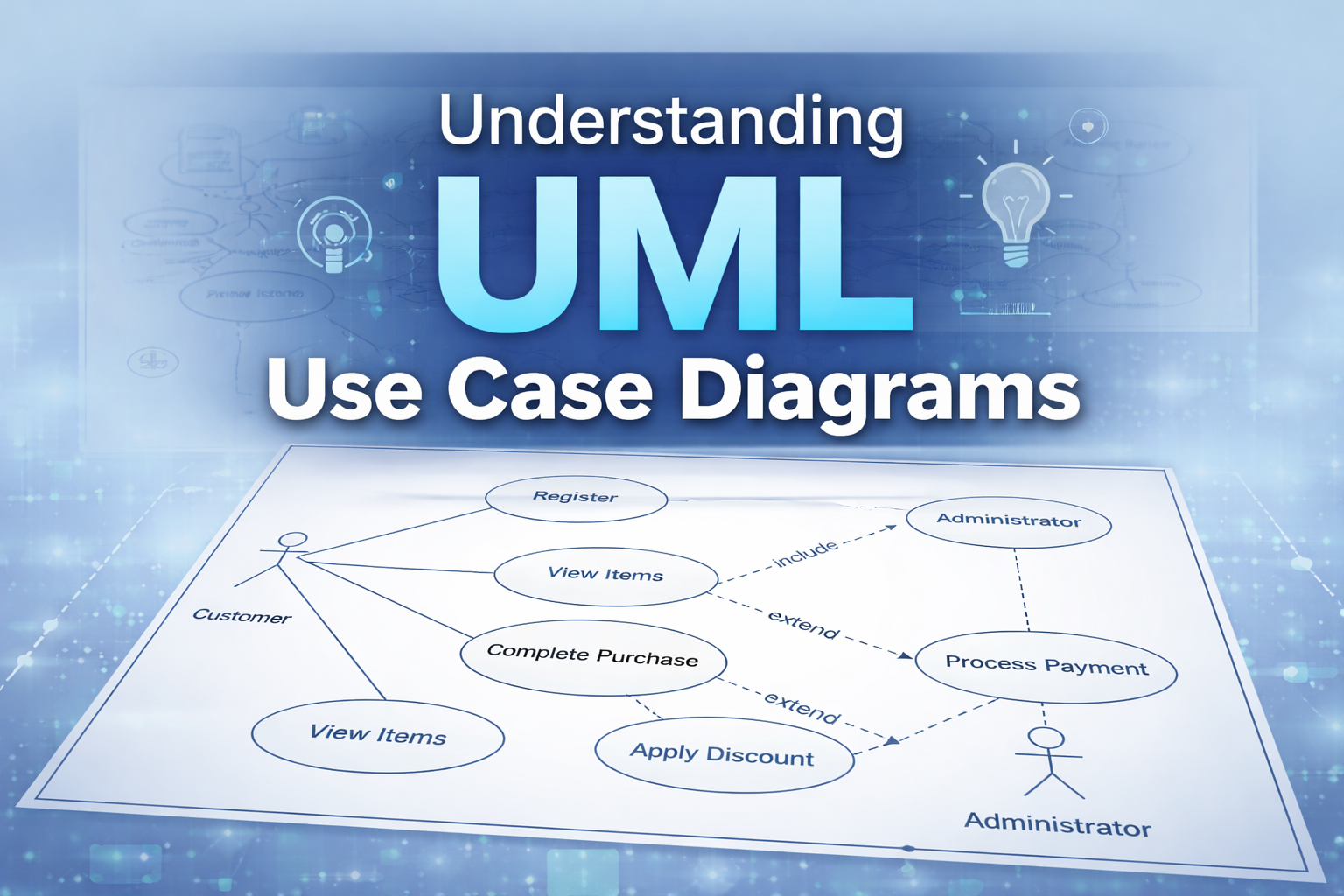

Master of Science

Boğaziçi UniversityMajor: Software Engineering

Key Courses

- Introduction to Object-Oriented Programming

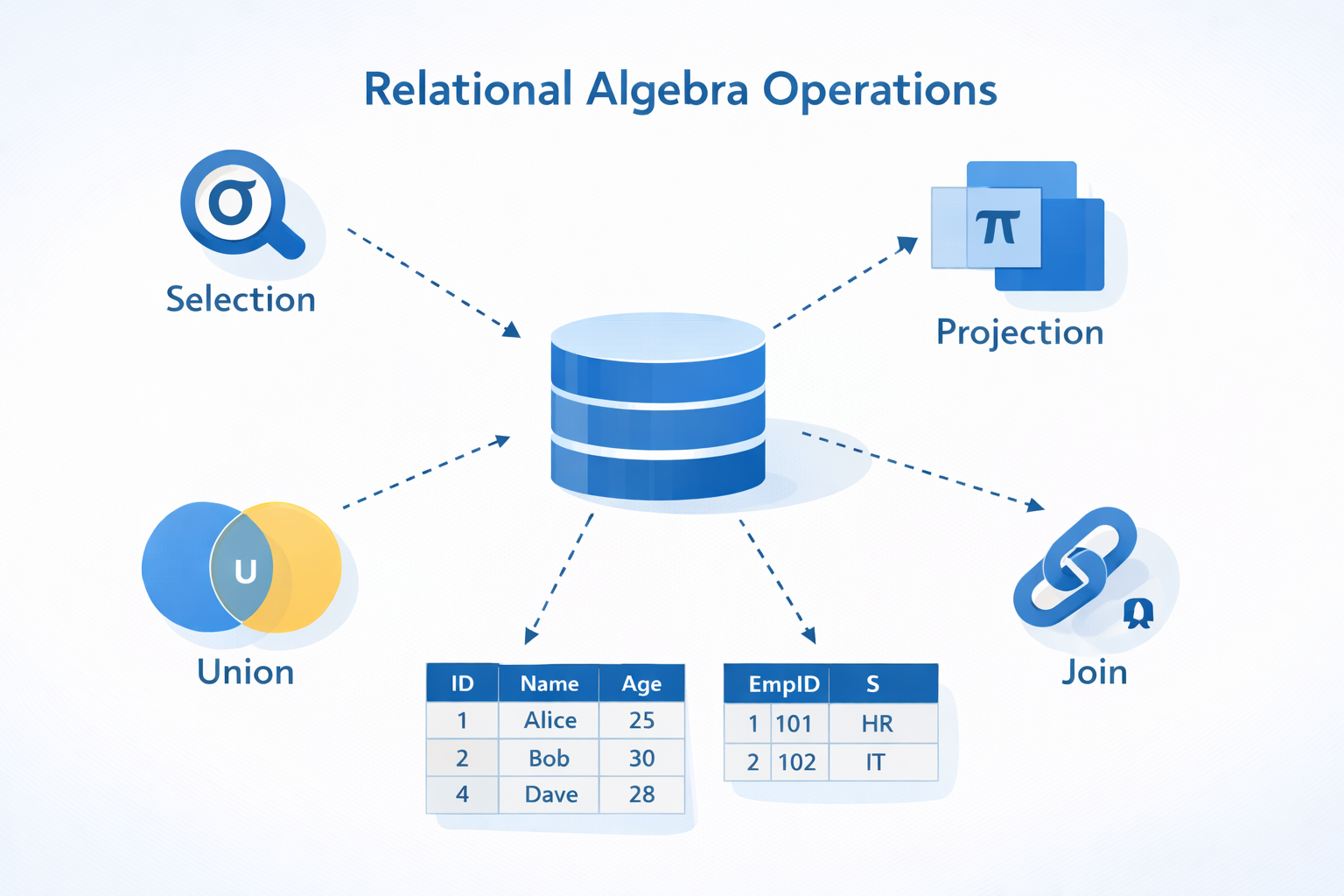

- Database Systems

- Data Structures and Algorithms

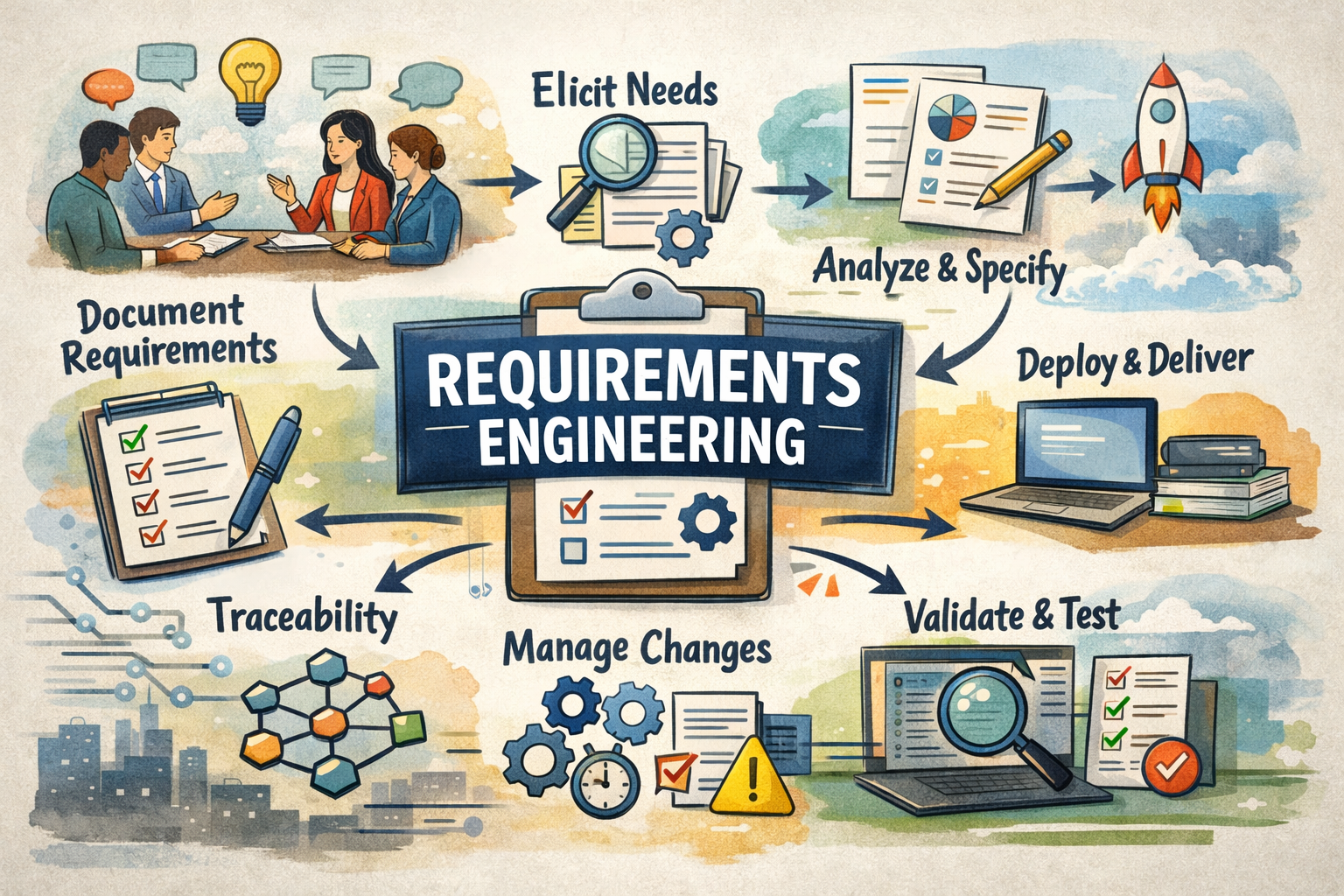

- Software Requirements Engineering

- Software Quality Assurance & Reliability

Bachelor of Arts

Yeditepe UniversityMajor: International Relations

Key Courses

- Introduction to Computer and Information Processing

- Advanced English I - II

- Principles of Microeconomics

- Principles of Macroeconomics

Certifications & Credentials

Professional certifications validating my Business Analysis expertise

Entry Certificate in Business Analysis (IIBA-ECBA)

International Institute of Business Analysis

Earned December 2025

Database Foundations: Intro to Databases

Earned July 2024

Featured Projects

Real-world projects showcasing data-driven business solutions

Unified Risk Scoring Platform for Insurance Products Bundling

A large insurance company operates four independent legacy systems serving different insurance product lines: Life, Auto, Home and Health. Each system was developed over the past two decades using different technologies, databases, and data models.

Loan Restructuring & Interest Recalculation Engine

The current spreadsheet-based process causes high error rates, customer disputes, and compliance risks due to limitations of the existing Loan Management System. The new solution operates alongside the LMS, supports all restructuring scenarios, ensures auditability and handles multiple changes per loan.

Fraud Flag Resolution Process Optimization

SecurePay Financial Services is a licensed payment service provider processing high volumes of transactions across multiple digital channels and serving millions of active customers. To manage fraud risk, the company relies on a rule based transaction monitoring system that flags suspicious activity for manual review and temporarily restricts customer accounts until investigations are completed.ays and inefficiencies in its fraud flag resolution process, leading to customer dissatisfaction and increased operational costs.

Latest Articles

Insights and tips on business analysis, data analytics, and career growth

Let's Connect

Find me across the web and let's collaborate