Fraud Resolution Process Optimization

SecurePay Financial Services is a licensed payment service provider processing high volumes of transactions across multiple digital channels and serving millions of active customers. To manage fraud risk, the company relies on a rule based transaction monitoring system that flags suspicious activity for manual review and temporarily restricts customer accounts until investigations are completed.Delays and inefficiencies in its fraud resolution process, leading to customer dissatisfaction and increased operational costs.

Date

August 2024

Industry

Financial Services

Role

Business Analyst

Client

SecurePay Financial Services

The Challenge

The existing fraud resolution process relied on a rule based transaction monitoring system and manual analyst judgment, resulting in inconsistent case outcomes, high false positive rates, unnecessary customer transaction blocks, and insufficient audit documentation that exposed the organization to regulatory risk.

The Solution

Designed a Fraud Resolution Decision Engine that introduces automated risk scoring, tiered resolution workflows, and standardized decision criteria. The solution enables instant auto resolution for low risk cases, guided analyst review for medium risk cases, structured escalation for high risk scenarios, and comprehensive audit trails to improve consistency, reduce customer friction, and ensure regulatory compliance.

1. Problem Definition and Current State Assessment

1.1 Business Context

SecurePay Financial Services operates a high volume payment platform processing tens of millions of transactions each month across multiple digital channels. Fraud risk represents a critical financial and reputational concern, with potential exposure reaching tens of millions annually if controls are ineffective. The organization relies on a centralized Fraud Operations team to monitor and resolve suspicious activity around the clock using a legacy rule based Transaction Monitoring System.

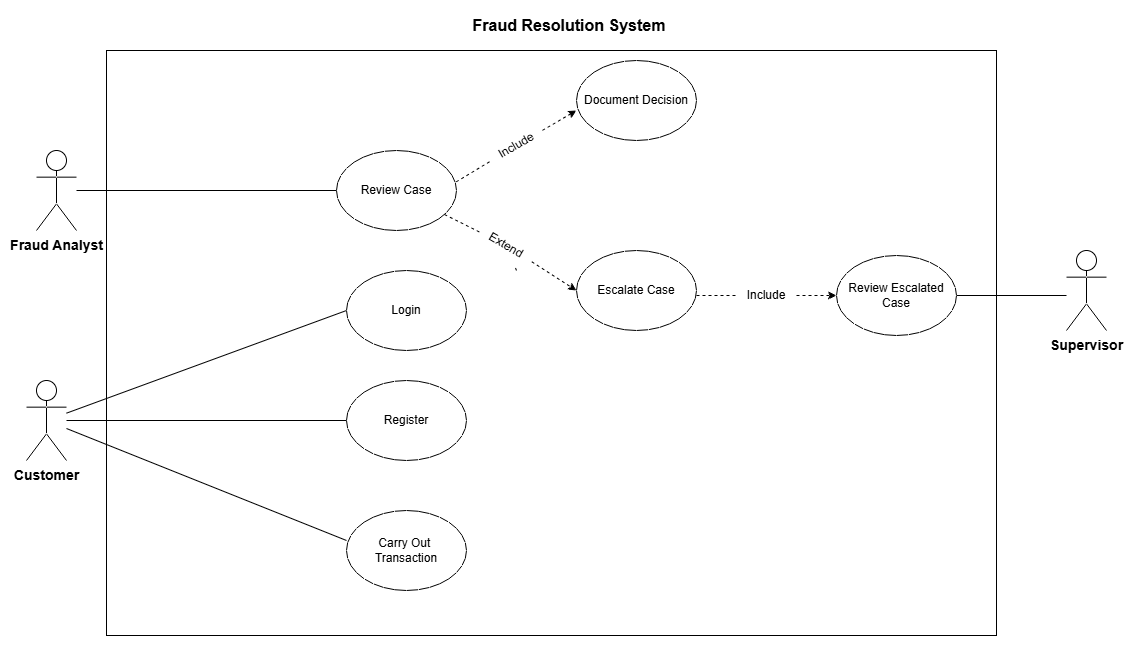

1.2 Current Fraud Detection Approach

The existing Transaction Monitoring System evaluates transactions against hundreds of predefined rules covering velocity patterns, geographic anomalies, transaction amounts, and device or behavioral signals. Transactions exceeding risk thresholds are flagged for manual review and customer accounts are temporarily restricted until an analyst resolves the case. While this approach provides broad coverage, it relies heavily on manual judgment and static rule logic.

1.3 Current Challenges

The current fraud operations model suffers from several systemic issues. Case handling is inconsistent due to the absence of standardized decision criteria, resulting in significant variation in analyst outcomes. A high false positive rate causes frequent unnecessary transaction blocks, negatively impacting customer experience and increasing churn risk. All flagged customers are treated uniformly regardless of history or risk profile, limiting the effectiveness of fraud prioritization. Escalation paths are unclear, leading to misrouted investigations, while insufficient documentation of manual overrides creates material regulatory compliance exposure.

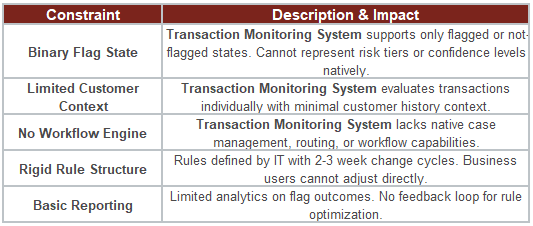

1.4 System Constraints

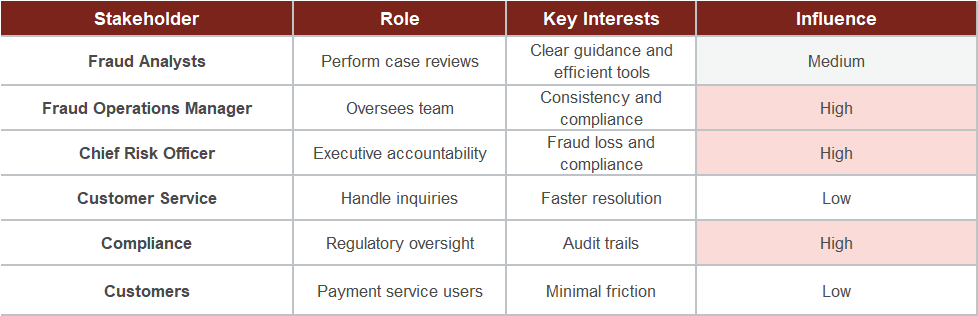

2.Stakeholder Analysis

2.1 Stakeholder Identification

A comprehensive stakeholder analysis was conducted to identify all parties with interest or influence in the Fraud Flag Resolution Process Optimization initiative. Key stakeholders were categorized based on their roles, responsibilities, and impact on the project outcomes.

3.Current State Analysis

3.1 Current Situation

The current fraud flag resolution process operates through a fragmented workflow that lacks standardization, formal decision criteria, and systematic documentation. When the Transaction Monitoring System identifies a potentially fraudulent transaction, the associated customer account is immediately placed into a restricted state that blocks all subsequent transactions. The flagged case enters a queue for manual review by fraud analysts, who evaluate available information and make disposition decisions based on individual judgment. The absence of risk-based differentiation means that all flagged customers experience identical treatment regardless of their relationship history or the nature of the triggering event. First-time customers with newly opened accounts receive the same blocking duration and review process as long-standing customers with years of positive transaction history. This uniform approach leads to unnecessary customer friction and increased churn risk, particularly among low-risk segments.

4.Proposed Solution

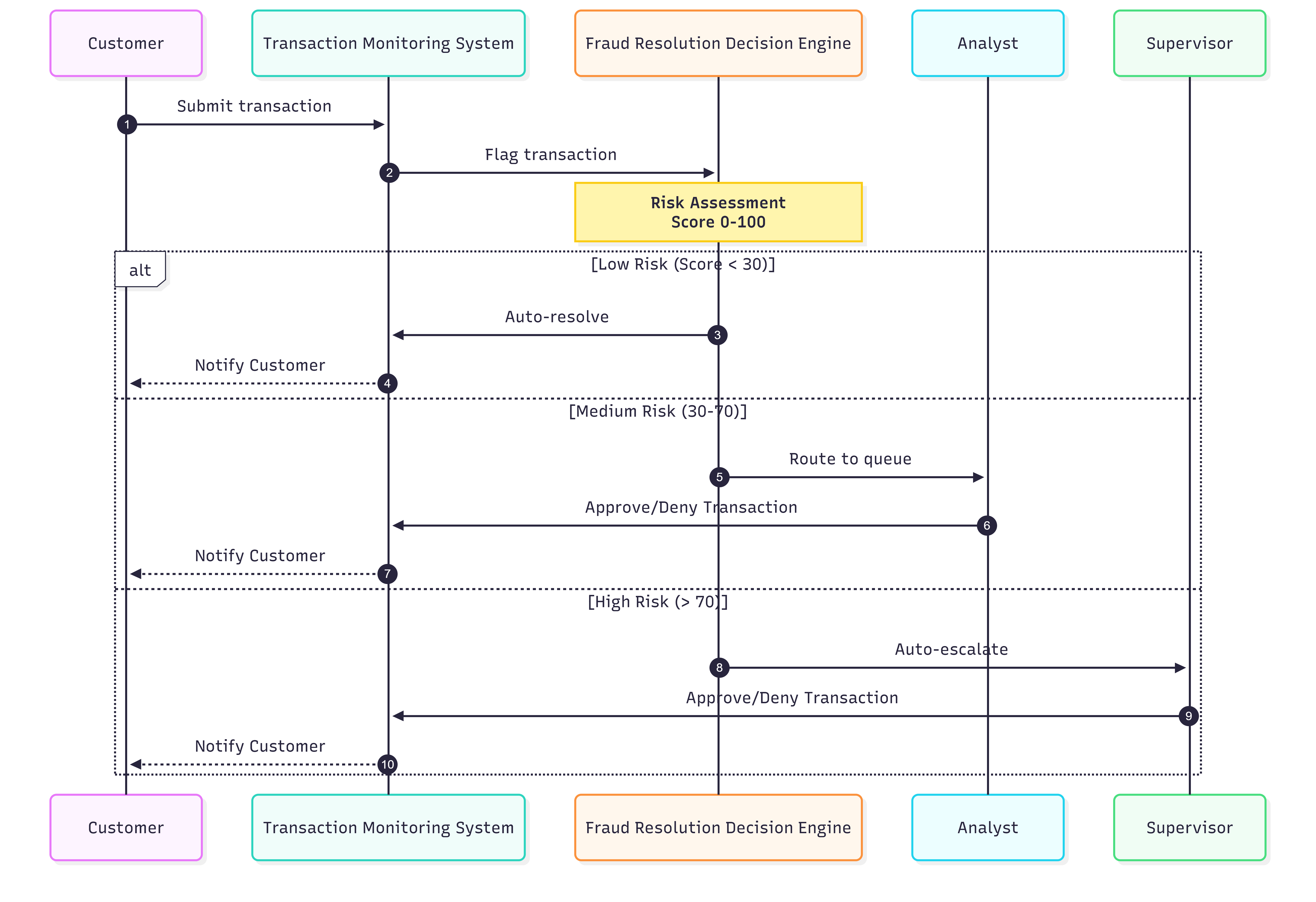

The proposed solution introduces a Fraud Resolution Decision Engine (FRDE) that transforms fraud flag handling from ad hoc analyst judgment into a structured, risk based process with standardized decision criteria, tiered workflows, and comprehensive audit capabilities. The FRDE operates as a decision support layer between the existing Transaction Monitoring System and fraud analysts. The solution is designed to balance fraud prevention, customer experience, regulatory compliance, and operational efficiency through risk based differentiation, ensuring that resolution approaches are aligned with the characteristics and risk level of each case.

4.1 Solution Architecture

The proposed solution introduces a Fraud Resolution Decision Engine (FRDE) that replaces ad hoc analyst judgment with a structured, risk based fraud resolution process. Operating as a decision support layer between the Transaction Monitoring System and fraud analysts, the FRDE applies standardized decision criteria, tiered workflows, and comprehensive audit capabilities to ensure consistent and compliant outcomes. The FRDE calculates a composite risk score for each flagged transaction using customer history, transaction behavior, prior fraud outcomes, account verification status, and triggering rules. Based on this risk assessment, cases are automatically resolved, routed for guided analyst review, or escalated to senior analysts. Analysts are supported through a unified interface that provides full customer context, rule based guidance, and enforces structured documentation, enabling balanced fraud prevention, reduced customer friction, regulatory compliance, and improved operational efficiency.

The Analyst Decision Support Interface provides analysts with a unified workspace that presents all relevant case information and decision guidance. The interface displays comprehensive customer context, risk indicators, and rule based recommendations, while enforcing structured documentation through mandatory fields to ensure consistency, traceability, and audit readiness before final case disposition.

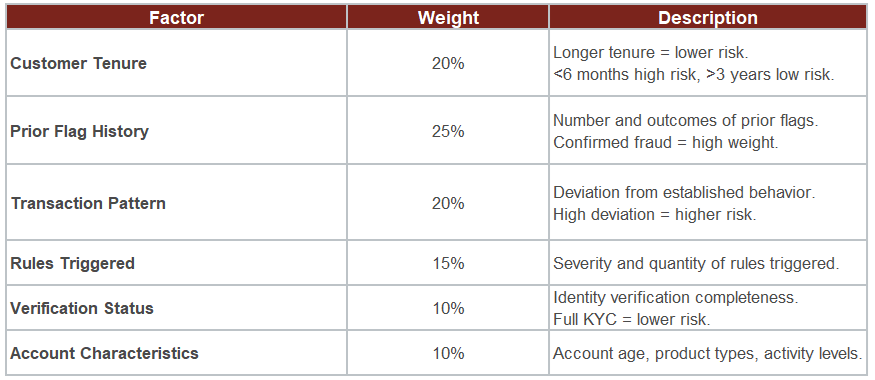

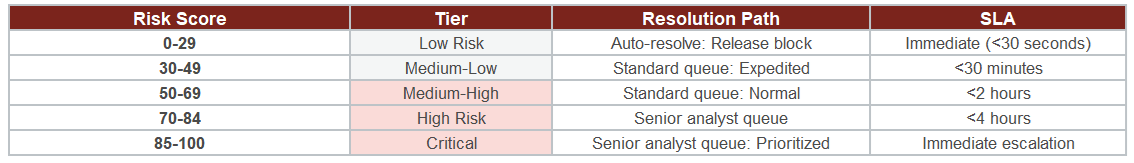

4.2 Risk Scoring and Resolution Tiers

The Risk Scoring Engine evaluates each flagged transaction using six weighted factors to generate a composite risk score ranging from zero to one hundred. Customer tenure accounts for twenty percent of the score, with longer relationships indicating lower risk. Prior flag history carries the highest weight at twenty five percent, increasing risk significantly for accounts with confirmed fraud incidents. Transaction pattern contributes twenty percent by measuring deviations from normal customer behavior. Rules triggered add fifteen percent based on the severity and number of detection rules activated. Verification status represents ten percent, where full identity verification reduces risk. Account characteristics make up the remaining ten percent, incorporating factors such as account age, product mix, and historical activity levels.

The resolution tier framework maps risk scores to predefined workflow paths and service level agreements. Scores from zero to twenty nine are classified as low risk and automatically resolved with immediate block release. Scores between thirty and forty nine are categorized as medium low risk and routed to an expedited analyst queue. Medium high risk cases with scores from fifty to sixty nine follow standard analyst processing, while high risk cases scoring seventy to eighty four are escalated to senior analysts. Critical cases scoring eighty five to one hundred are automatically escalated to the Senior Analyst for immediate review.

5.Requirements of the Fraud Resolution Decision Engine

5.1 Definition

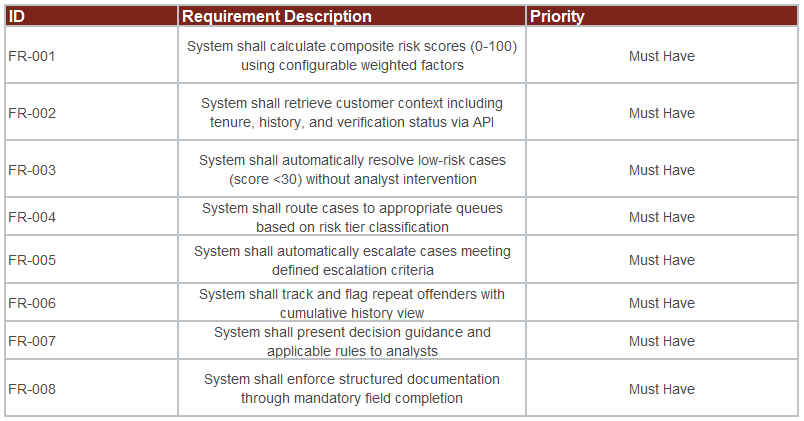

This section defines the functional and non-functional requirements for the Fraud Resolution Decision Engine (FRDE). The requirements have been elicited through stakeholder interviews with fraud analysts, operations management, and compliance officers, assessment of existing Transaction Monitoring System capabilities and workflow gaps, and alignment with regulatory audit requirements and customer experience objectives. Each requirement is assigned a unique identifier to ensure end to end traceability throughout the project lifecycle.

5.2 Functional Requirements

Functional requirements define the core capabilities the Fraud Resolution Decision Engine must provide to support structured, risk based fraud flag resolution. These requirements encompass automated risk scoring, tiered resolution workflows, analyst decision support and system integration to ensure consistent, efficient and compliant case handling.

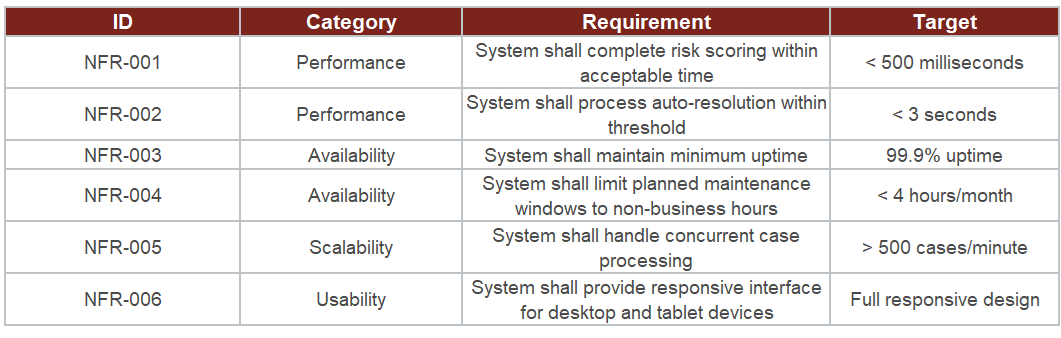

5.3 Non-Functional Requirements

Non-functional requirements specify the performance, scalability, security, and usability standards the Fraud Resolution Decision Engine must meet. These criteria ensure the system operates reliably under load, protects sensitive data and provides an intuitive user experience for analysts.

6.Conclusion

This Business Analysis Document presents a comprehensive and scalable solution for addressing the operational, regulatory, and customer experience challenges associated with fraud flag resolution. The proposed Fraud Resolution Decision Engine (FRDE) replaces inconsistent, judgment driven handling with a standardized, risk based framework that ensures fairness, transparency, and auditability across all fraud resolution activities. By introducing structured risk scoring, tiered workflows, and decision support for analysts, the solution enables faster resolution of low risk cases, more focused investigation of higher risk scenarios, and consistent escalation for critical fraud events. This approach significantly reduces unnecessary customer friction while strengthening fraud prevention and regulatory compliance. Expected outcomes include substantial improvement in decision consistency across the analyst team, significant reduction in resolution time for false positive cases, and measurable decrease in customer complaints related to fraud blocks. The initiative delivers a compelling return on investment with rapid payback, driven by operational efficiency gains, recovered revenue from faster legitimate customer unblocking, reduced churn, and avoided regulatory penalties.

Outcomes & Impact

- Improved consistency of fraud resolution decisions across all analyst teams

- Significantly reduced resolution time for low risk and false positive fraud cases

- Decreased customer complaints related to account blocks and delayed access

- Reduced operational effort by automating low risk case handling

- Strengthened regulatory compliance through complete auditability and traceable decision logic

- Lowered customer churn by minimizing unnecessary friction for legitimate customers