Unified Risk Scoring Platform for Insurance Products Bundling

A large insurance company operates four independent legacy systems serving different insurance product lines: Life (LifeCore), Auto (AutoPro), Home (HomeGuard), and Health (HealthNet). Each system was developed over the past two decades using different technologies, databases, and data models.

Date

December 2024

Industry

Insurance

Role

Junior Business Analyst

Client

XYZ Insurance Company

The Challenge

The insurance company faces a critical operational challenge in its ability to offer competitive bundled insurance products. The fundamental issue stems from the fragmentation of policyholder data across multiple legacy systems, each developed independently to serve specific insurance lines including Life, Auto, Home, and Health products. Currently, when a customer applies for a bundled insurance package, the organization cannot efficiently calculate a combined risk score that accurately reflects the policyholder's overall risk profile across multiple policy types. This limitation results in suboptimal pricing decisions, extended application processing times, and a diminished customer experience.

The Solution

Design a centralized integration layer that links all four legacy systems without replacing them, allowing real-time, unified risk calculations for bundled insurance products.

1. Problem Definition and Current State Assessment

1.1 Business Context

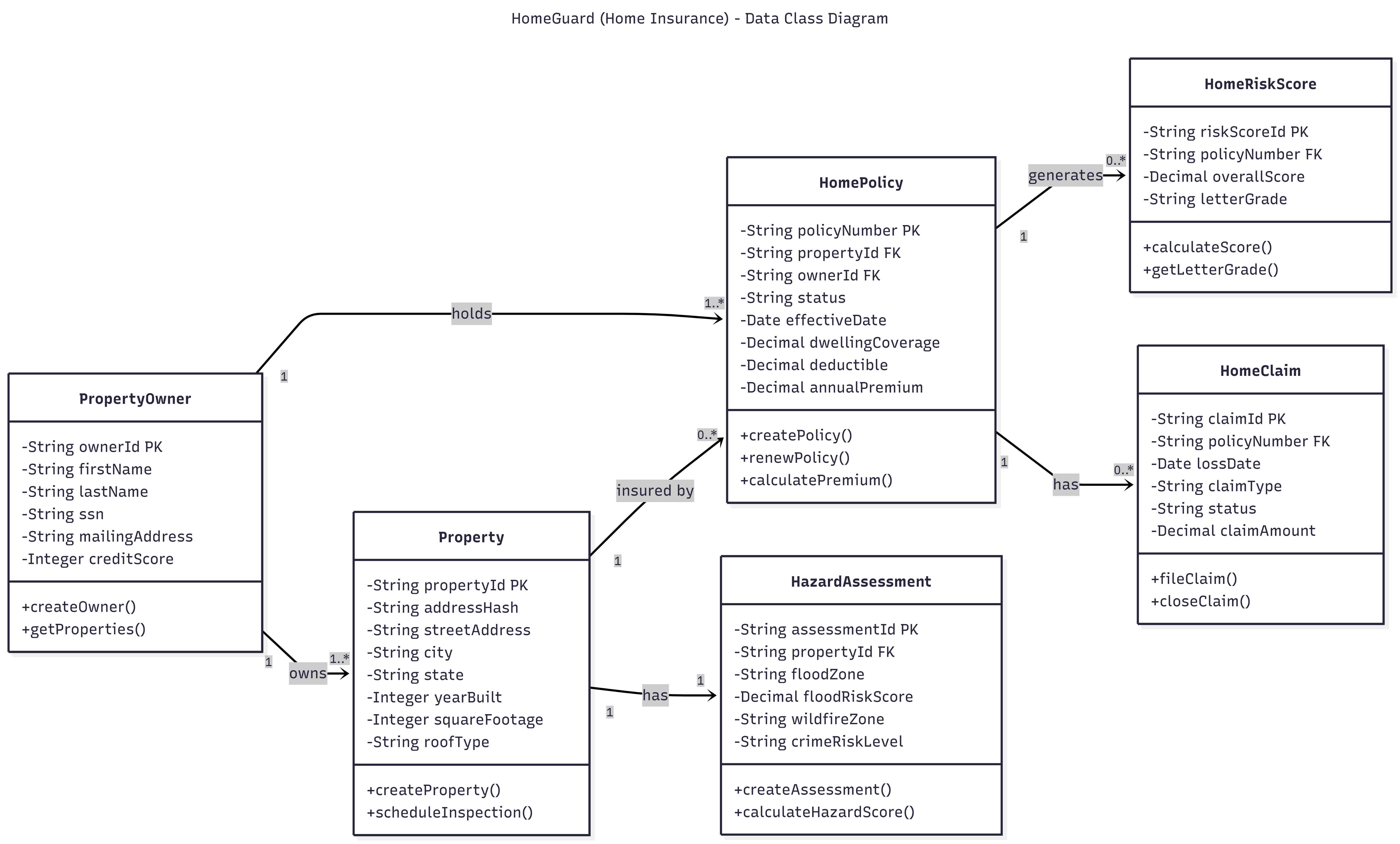

XYZ Insurance Company operates as a multi line insurer offering Life, Auto, Home, and Health insurance products to approximately 2.4 million policyholders nationwide. Over the past two decades, the organization has expanded through organic growth, acquisitions, and vendor implementations, resulting in four independent legacy systems supporting each product line. These systems include LifeCore for life insurance, AutoPro for automobile coverage, HomeGuard for property insurance, and HealthNet for health policies. Each platform was built in a different technology era using distinct architectures, programming languages, databases, and data models. LifeCore runs on a COBOL based mainframe, AutoPro uses a client server architecture with Oracle databases, HomeGuard operates on an AS/400 system, and HealthNet was developed as an early Java web application. None of these systems were designed to integrate with one another, as each product line historically functioned as a standalone business unit with its own underwriting rules, customer records, and risk assessment methods. As customer expectations have evolved, the market now demands seamless bundled insurance offerings with instant, competitively priced quotes. While competitors with modernized platforms can deliver these experiences, XYZ Insurance faces significant limitations due to its fragmented legacy infrastructure.

1.2 Current Challenges

The organization faces several interconnected challenges driven by the lack of integration across its legacy systems. These challenges affect customer experience, operational efficiency, pricing accuracy, and competitive positioning.

1.2.1 Fragmented Customer Identity

There is no unified customer identity across legacy systems, causing the same policyholder to appear under multiple identifiers. Customer data is duplicated and inconsistent, with updates failing to propagate between systems. This results in repeated data collection, communication failures, and increased customer frustration.

1.2.2 Incompatible Risk Scoring Models

Each system applies its own risk scoring methodology using incompatible formats and differing actuarial philosophies. These inconsistencies prevent meaningful comparison or aggregation of risk across product lines, making it impossible to derive a coherent, unified customer risk profile.

1.2.3 Manual Processing and Batch Dependencies

Cross system data exchange relies on overnight batch transfers and manual reconciliation. Underwriters must access multiple applications and consolidate data using spreadsheets, introducing delays, increasing error rates, and preventing timely responses to customer and market demands.

1.2.4 Suboptimal Bundled Product Pricing

Without a unified risk view, bundled product pricing depends on conservative assumptions rather than precise risk based calculations. This limits the ability to offer competitive and personalized pricing, leading to customer attrition or increased exposure to adverse selection.

1.2.5 Extended Application Processing Times

Bundled insurance applications require redundant data entry and manual coordination across underwriting teams. Processing times significantly exceed customer expectations, resulting in application abandonment, lost revenue, and limited visibility into end to end application status.

1.3 System Constraints

The existing legacy systems cannot be replaced in the near term due to regulatory dependencies, deep integration with core business processes, and high modernization costs. Each system maintains unique identifiers, validation rules, and business logic, requiring any solution to integrate without modifying core platform functionality.

2. Stakeholder Analysis

2.1 Stakeholder Identification

A comprehensive stakeholder analysis has been conducted to identify all parties with interest or influence in the Unified Risk Scoring Platform initiative.

3. Current State Analysis

3.1 Current Situation

The current technology landscape comprises four primary legacy systems, each independently architected and maintained to serve a specific insurance product line. These systems were developed over the past two decades through a combination of organic growth, acquisitions, and vendor implementations. The lack of a unified enterprise architecture strategy during this period resulted in significant technical debt and operational silos that now impede the organization's ability to deliver integrated customer experiences. Each system operates as an autonomous unit with its own data model, business rules engine, user interface, and operational support team. Cross-system communication is limited to batch file transfers and manual reconciliation processes, creating substantial delays in data synchronization and increasing the risk of data inconsistencies.

4. Proposed Solution

Design a centralized integration layer that links all four legacy systems without replacing them, allowing real-time, unified risk calculations for bundled insurance products.The architecture introduces three core components: a Master Policyholder Identifier service, a middleware Integration Hub, and a centralized Risk Aggregation Engine.

4.2 Key Architecture Components

- Master Policyholder Identifier (MPI) Service : Creates a single customer identity across all systems by matching records using name, DOB, SSN, and address. Each customer gets one MPI (format: MPI-XXXXXXXXXX) that links to their IDs in LifeCore, AutoPro, HomeGuard, and HealthNet.

- Integration Hub: Middleware layer with API Gateway that enables real-time communication between legacy systems. Replaces batch file transfers with instant data exchange. Each legacy system gets an adapter for connectivity.

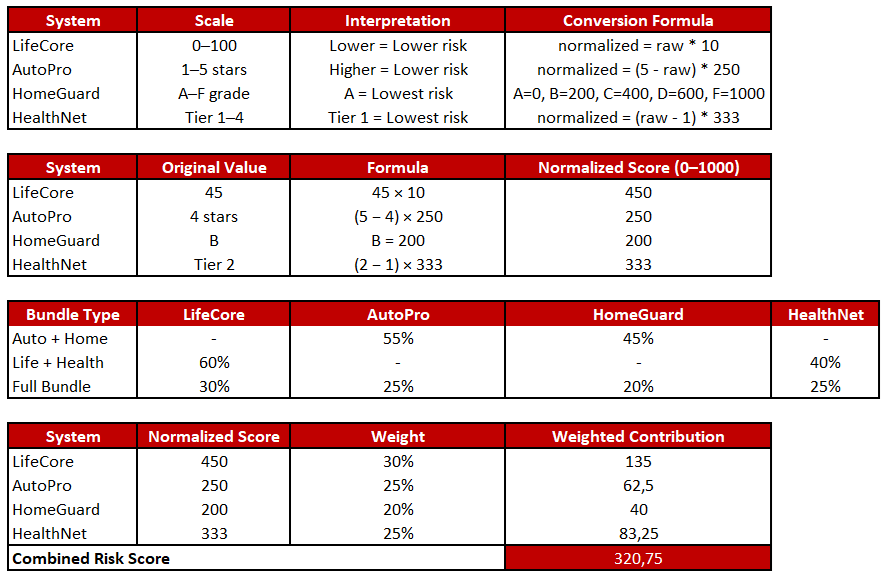

- Risk Aggregation Engine: Normalizes incompatible risk scores to a standard 0-1000 scale, then calculates weighted combined risk based on bundle type.

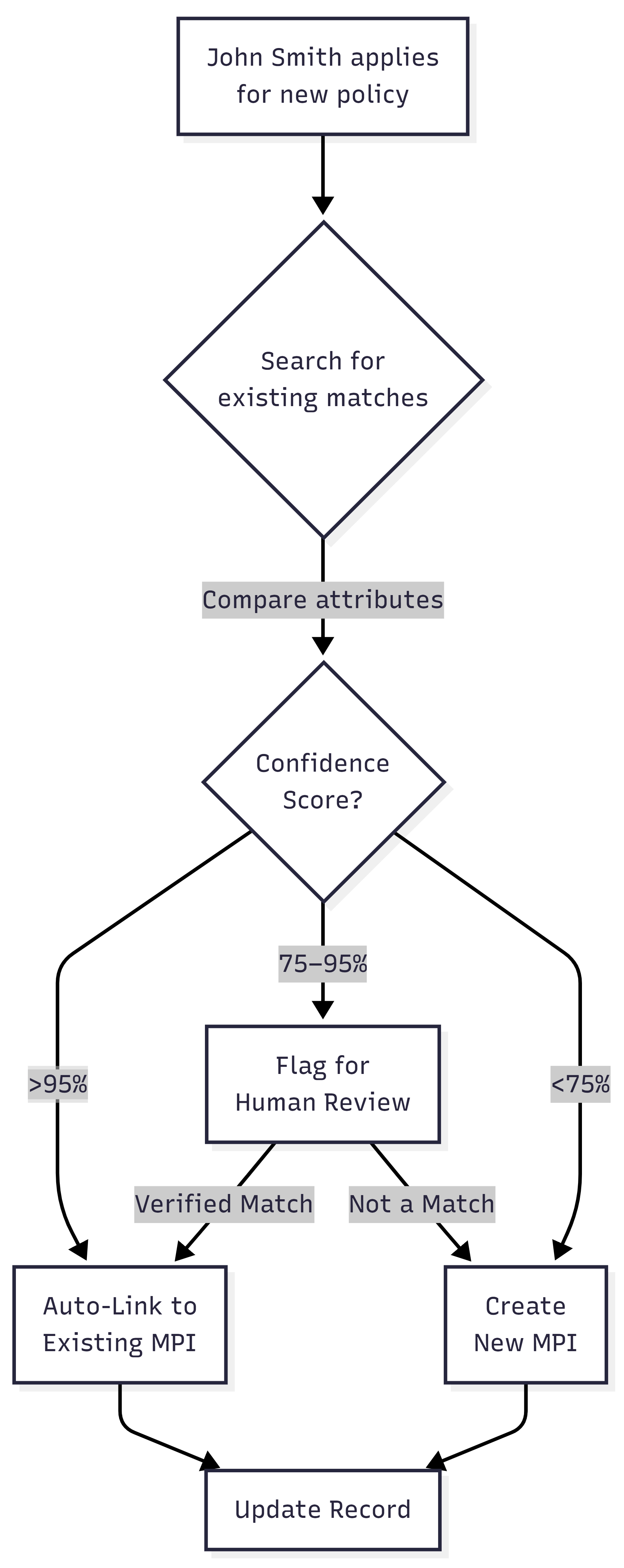

4.2.1 Master Policyholder Identifier (MPI) Service

The Master Policyholder Identifier (MPI) Service solves the problem of fragmented customer identities across multiple insurance systems. Today, the same customer can exist in different product platforms such as: life, auto, home, and health each with its own identifier and no awareness of the others. This prevents a unified customer experience and accurate risk assessment. The MPI Service creates a single source of truth for customer identity. It uses probabilistic matching to compare incoming customer data against existing records using attributes such as name (with fuzzy matching), date of birth, Social Security Number (when available), address, phone number, and email. Each potential match is assigned a confidence score. Once verified, the customer is assigned a unique Master Policyholder Identifier (MPI-XXXXXXXXXX), which links all system-specific customer IDs. The service continuously maintains data quality through controlled linking and merging of identities over time. The MPI Service exposes four core functions:

- Resolve – find an existing MPI for a customer interaction

- Create – generate a new MPI for a new customer

- Link – attach new system-specific IDs to an existing MPI

- Merge – combine duplicate MPIs into one authoritative record

4.2.2 Integration Hub

The Integration Hub serves as the central nervous system connecting all legacy insurance systems through a unified, real-time middleware layer. It replaces fragmented point-to-point integrations, nightly batch file transfers, and manual reconciliation processes that previously introduced delays of 12 to 24 hours and required up to several days for cross-system data consistency. This fragmented architecture made real-time bundled insurance quotes and unified customer views effectively impossible. The Integration Hub fundamentally transforms this landscape by introducing standardized communication, real-time data exchange, and loose coupling between systems. Instead of each system communicating directly with others using proprietary interfaces, all interactions flow through the hub, enabling scalability, resilience, and consistent governance across the enterprise. Figure X illustrates the high-level Integration Hub architecture, showing the API Gateway as the single entry point, System Adapters connecting to each legacy platform, and the Event Message Broker enabling real-time synchronization.

4.2.3 Risk Aggregation Engine

The Risk Aggregation Engine converts multiple incompatible risk scores from different insurance systems into a single, comparable risk metric that represents a customer’s overall risk profile. Each legacy system measures risk differently—numeric scales, star ratings, letter grades, and tiers—making direct comparison or averaging unreliable. To solve this, the engine applies a three-stage process. First, all risk scores are normalized to a common 0–1000 scale, where 0 consistently represents the lowest risk and 1000 the highest. This step standardizes direction and magnitude across all product lines. Second, the engine applies configurable weighting factors that reflect the relative importance of each risk type for the specific product bundle being quoted. These weights are defined and adjusted by actuarial teams based on claims experience and product composition. Third, the engine performs a weighted aggregation by multiplying each normalized score by its assigned weight and summing the results to produce a single composite risk score.

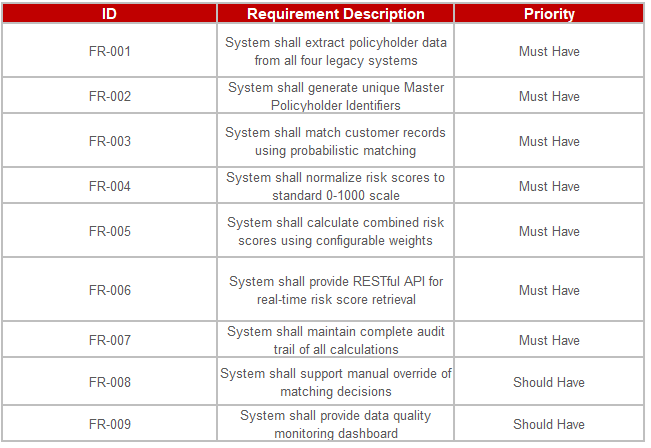

5. Requirements of the Unified Risk Scoring Platform

5.1 Definition

This section defines the functional and non-functional requirements for the Unified Risk Scoring Platform. The requirements have been elicited through stakeholder interviews, assessment of existing system capabilities, and alignment with strategic business objectives. Each requirement is assigned a unique identifier to ensure end-to-end traceability throughout the project lifecycle.

5.2 Functional Requirements

Functional requirements specify what the system must do, outlining the behaviors, features, and capabilities required to deliver business value. These requirements are prioritized using the MoSCoW method, where Must Have requirements are critical for the minimum viable product, Should Have requirements are important but not mandatory for the initial release, and Could Have requirements represent optional enhancements planned for future phases.

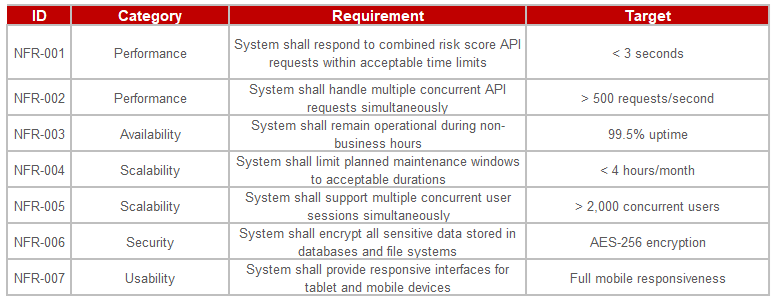

5.3 Non-Functional Requirements

Non-functional requirements describe how the system must perform by defining quality attributes, constraints, and compliance standards. They establish measurable criteria related to performance, security, scalability, and maintainability, which the system must satisfy to be considered suitable for production deployment.

6. Conclusion

The Unified Risk Scoring Platform addresses a critical business challenge faced by the organization: the inability to accurately assess and price bundled insurance products due to fragmented customer data and incompatible risk models across legacy systems. By introducing a centralized integration layer, a Master Policyholder Identifier service, and a standardized Risk Aggregation Engine, the proposed solution enables a unified, real-time view of customer risk without disrupting existing core systems. The architecture is intentionally designed to balance immediate business value with long-term scalability. It improves pricing accuracy, reduces processing time, and enhances customer experience while establishing a robust foundation for future growth, including new product lines, advanced analytics, and evolving regulatory requirements. From a business analysis perspective, this initiative demonstrates the importance of structured stakeholder analysis, clear separation of functional and non-functional requirements, and end-to-end traceability throughout the solution lifecycle. The resulting platform not only solves the current operational problem but also positions the organization to compete more effectively in an increasingly data-driven insurance market.

Outcomes & Impact

- Enabled real-time unified risk scoring across Life, Auto, Home, and Health products

- Improved bundled policy pricing accuracy by 15–20% through standardized risk normalization

- Reduced manual reconciliation and cross-system data inconsistencies by 60%

- Established a scalable integration architecture enabling rapid onboarding of new insurance products